Can I Submit a Joint Proposal with my Partner?

It is possible to submit a Joint Consumer Proposal, which involves two or more people jointly filing for debt settlement. However, this option is limited in its applicability.

To qualify for a Joint Consumer Proposal, either ALL or a SIGNIFICANT MAJORITY of the assets and liabilities or debts must be identical.

This situation, although uncommon, typically arises when only one person within a household is employed, and their financial assets and liabilities are intermingled. To illustrate this concept, we provide scenarios where a joint filing may be suitable and others where it is clearly unsuitable.

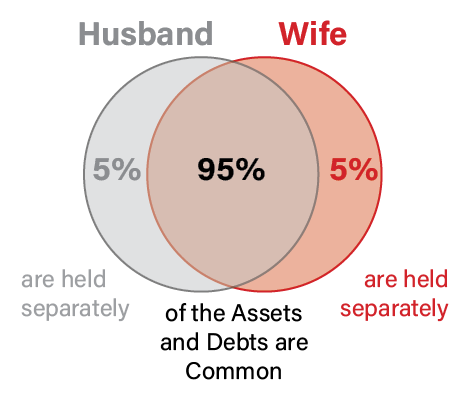

A POSSIBLE JOINT CONSUMER PROPOSAL SCENARIO

Only 5% of the Couple’s Assets and Debts are held Separately

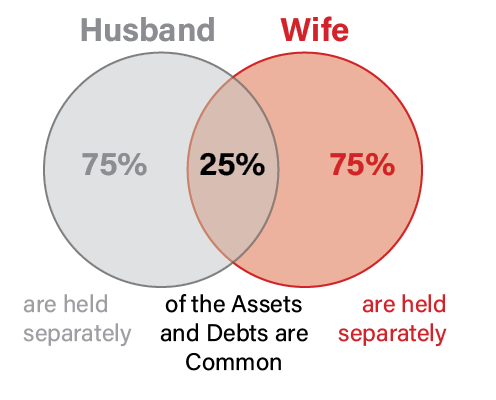

SEPARATE CONSUMER PROPOSALS REQUIRED

The majority of the Couple’s Assets and Debts are held Separately

WHAT ARE THE ADVANTAGES AND DISADVANTAGES?

The primary advantage of filing a joint consumer proposal is that it addresses all aspects of your debts collectively, reducing the administrative costs associated with your proposal. This, in turn, allows your creditors to receive a larger portion of your payments, which can serve as an incentive for them to accept your proposal.

However, there are notable disadvantages to filing a joint consumer proposal. One significant drawback is that you are jointly and severally liable for the entire term of the proposal. If one party chooses not to participate or if a couple separates with disputes, one person may be required to shoulder the entire payment burden if the other party refuses to participate.

For example, if the monthly payment in your joint proposal is $800.00, both parties are collectively responsible for the entire amount, regardless of any future developments. It is not a case where each person pays $400.00 per month with separate payments.

To be clear, we are not discouraging anyone from considering joint consumer proposals, but it is important to note that a common scenario involves joint consumer proposals where a couple separates during the proposal's term. In such cases, one individual may be unable or unwilling to make payments, leading the other to assume full responsibility to prevent bankruptcy.

Therefore, if there is any possibility of marital discord or a likelihood of the parties going their separate ways, a joint consumer proposal may not be the most suitable option.

Feel free to get in touch with us! We are eager to elucidate the mechanics of a consumer proposal and elucidate the advantages you can anticipate from consolidating your payments into one manageable monthly installment, devoid of the exorbitant interest rates you've encountered in the past.

Frequently Asked Questions

Empowering Your Financial Future, One Proposal at a Time

What is a Consumer Proposal?

A Consumer Proposal is a formal debt settlement arrangement regulated by the government of Canada. It allows individuals to negotiate with their creditors to repay a portion of their debt over a set period, usually up to five years, in a more manageable way.

Who is eligible for a Consumer Proposal?

Most unsecured debts, such as credit card debt and personal loans, can be included in a Consumer Proposal. To be eligible, you must have a stable source of income and owe less than $250,000 (excluding your mortgage) as of the date you file.

How does a Consumer Proposal affect my creditors?

When you file a Consumer Proposal, it legally binds all your unsecured creditors. They must stop all collection activities, including calls, letters, and legal actions. Creditors then have the opportunity to vote on whether to accept your proposal.

What are the advantages of a Consumer Proposal?

Some benefits of a Consumer Proposal include lower monthly payments, a fixed repayment schedule, and protection from legal actions by creditors. It also allows you to keep your assets and avoid the stigma of bankruptcy.

Are there any disadvantages to a Consumer Proposal?

While a Consumer Proposal offers several advantages, it will appear on your credit report for three years after you complete it. This can affect your ability to obtain credit during that time.

What Does the Trustee Do?

The insolvency or bankruptcy trustees job is to:

Explain your options

Give advice and information

Complete all documentation

Deal with creditor on your behalf

Guide and help you through the bankruptcy process

As well, bankrupts are required to complete two financial counselling sessions, directed by the trustee.

How is the amount to be paid in a Consumer Proposal determined?

The amount you offer to pay in your Consumer Proposal is based on your income, expenses, and the value of your assets. It should be an amount that you can reasonably afford.

Can I make changes to my Consumer Proposal once it's accepted?

It is possible to modify your Consumer Proposal under certain circumstances, but any changes must be approved by your creditors and the court.

Will my Consumer Proposal be accepted by creditors?

The acceptance of your Consumer Proposal depends on your creditors' votes. If the majority in dollar value of your creditors approve it, your proposal is considered accepted.

What happens if my Consumer Proposal is not accepted?

If your Consumer Proposal is not accepted, you have the option to revise and resubmit it. Alternatively, you may explore other debt relief options, such as bankruptcy.

How long does a Consumer Proposal stay on my credit report?

A Consumer Proposal will remain on your credit report for three years after you complete it. Afterward, it will be removed from your credit history. It's crucial to consult with a licensed insolvency trustee or financial advisor to determine if a Consumer Proposal is the right solution for your specific financial situation.

Client Voices: Our Success Stories and Testimonials

"At, Consumer Proposals Hub, we don't just help with your financial challenges; we care about your journey toward a debt-free future because your well-being matters to us."

Emily Wexler

When I was drowning in debt and feeling overwhelmed, their team stepped in and guided me through the entire consumer proposal process with professionalism and empathy. From the initial consultation to the final approval, they were with me every step of the way.

John & Mary Klim

We recently used Consumer Proposals Hub to help us navigate our financial difficulties through a consumer proposal. Overall, we had a positive experience with them. Their team was knowledgeable, and they did a great job explaining the entire process to us. They also helped negotiate with our creditors and create a proposal that we could afford.

Alex Gorshkovich

I can't thank Consumer Proposals Hub enough for the incredible support they provided during one of the toughest periods of my life. From the very first meeting, they made me feel at ease and assured me that they could help me find a way out of my debt nightmare.

© 2026 Consumer Proposals Hub, All Rights Reserved